Last updated:

Scan our Heymondo review to discover the benefits and drawbacks of this innovative travel insurance company. See for yourself if it’s the right travel insurance choice for you!

Traveling is all about embracing the unknown, but that doesn’t mean you want to be caught off guard. That’s why we get travel insurance every time we hit the road, and Heymondo is our pick for our next trip.

It’s not perfect, though nothing is (well, except maybe Häagen-Dazs Cookies & Cream ice cream), but there are some real perks that make Heymondo worth considering. No messy paperwork, no deductibles, and a handy app that gives you 24/7 worldwide assistance – that’s pretty useful when you’re far from home. The ease of getting a quote is a big plus too – just a few clicks and you’re done.

Whether you’re planning a quick getaway or a longer adventure, it’s good to know that Heymondo has options that might fit your needs.

Here’s our honest take on how it stacks up.

Heymondo travel insurance

Traveling is an adventure, but let’s be real – sometimes it comes with its share of hiccups. Over the years, we’ve learned the hard way that having solid travel insurance is non-negotiable.

A few years back, I ended up in a hospital in Thailand for three days. It definitely was not part of the plan.

And then there was the time our son got injured in Greece. Both were stressful situations, but knowing we had travel insurance meant that at least we didn’t have to worry about facing a massive medical bill on top of everything else. Having that safety net was a game-changer.

Why We Chose Heymondo

One of the things I appreciate most about Heymondo is how simple it is to get a quote. I’m not a fan of filling out endless forms, so the fact that I could just select the type of insurance, plug in a few basic details like our destination and travel dates, and instantly get a quote was a huge win for me. There was no need to painstakingly enter birthdates and names for each of the four of us, which, honestly, saved me a lot of time and hassle.

But ease of use isn’t the only reason I’ll be using Heymondo.

What Heymondo Offers

Heymondo offers a range of coverage options that suit different types of trips. Whether you’re planning a short vacation, a business trip, or a long stay, there’s likely a plan that fits your needs.

Here’s a quick breakdown:

- Travel Insurance: For your next leisure or business trip, Heymondo has you covered.

- Annual Multi-Trip Travel Insurance: If you’re a frequent traveler, this might be a great option. It covers all the trips you take in a year, as long as each trip is under 60 days.

- Long Stay Travel Insurance: Planning an extended stay? Heymondo’s got a flexible plan that covers trips longer than 90 days.

One of the standout features is the Covid-19 coverage. It includes 24/7 worldwide assistance and covers things like medically prescribed PCR tests and cancellation in case of severe illness or death due to Covid-19 (in policies that include trip cancellation). This kind of flexibility and comprehensive coverage brings a lot of peace of mind, especially with everything that’s happened in the last few years.

My Heymondo Quote

I was really curious what travel insurance would cost for me, for a five day trip down to the USA from Canada.

So, I got a quote from Heymondo travel insurance for me (I’m Canadian) traveling five days worldwide including USA.

The quote was insanely easy to get. I just entered my trip dates, where I was going, and selected the type of insurance (annual or single trip). Just a few clicks, and I had my quote. No annoying medical questionnaires, or endless scrolling to select drop-down dates. My quote took all of about 60 seconds.

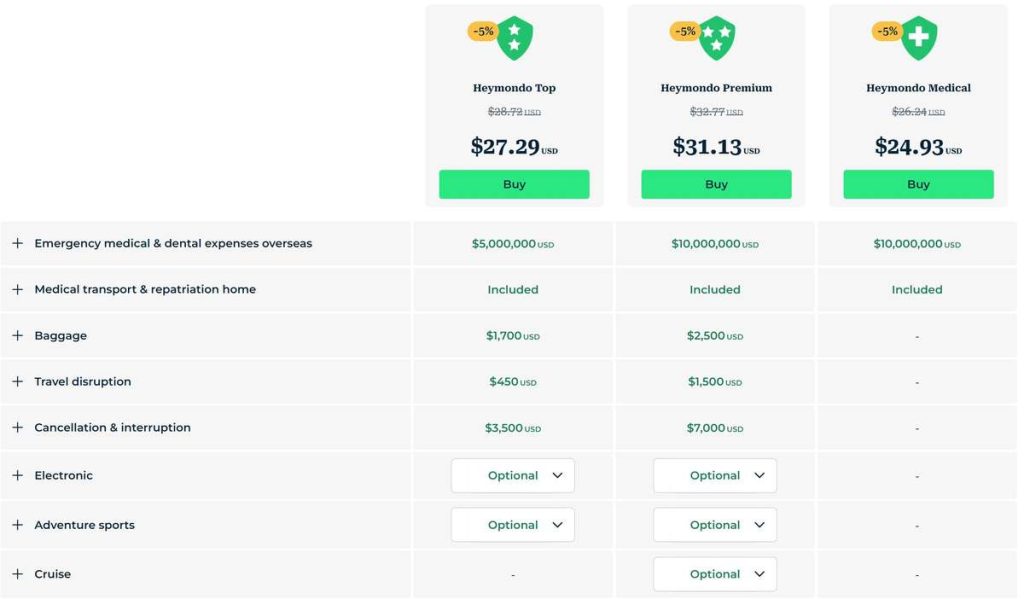

The Heymondo Medial insurance, the most basic, cost $24.93. That included a whopping $10 million USD emergency medical and dental expenses overseas. PLUS medical transport and repatriation home. The medical transport and repatriation home is a big deal to me, because if something really serious happens, I’d want to be transported back to Canada.

The Heymondo Top insurance had a few extra bells and whistles, including $1700 USD baggage coverage, $450 USD travel disruption, and $3.500 trip cancellation and interruption. It also had $10 million USD emergency medical and dental expenses overseas. PLUS medical transport and repatriation home.

The Heymondo Premium insurance had $2,500 baggage insurance, $1.500 travel disruption, and $7,000 trip cancellation and interruption. It also had $10 million USD emergency medical and dental expenses overseas. PLUS medical transport and repatriation home.

Are adventure sports, electronics, or cruise insurance included in the travel insurance?

I could get optional adventure sports, electronics, or cruise insurance on the Heymondo Top and Heymondo Premium Plans. I couldn’t get it added to the Heymondo basic.

The Heymondo App: A Handy Tool

The Heymondo app is another feature I found incredibly useful. It’s like having a travel assistant right in your pocket.

Need to chat with a doctor? You can do that directly through the app’s 24/7 medical chat. Got a question about your policy or need to file a claim? The app handles that too, along with free online assistance calls from anywhere in the world. All your policy details are also stored in the app, so they’re easy to access whenever you need them.

You can get the app on Google Play or the App store.

Need more details?

Because travel insurance policies can change without warning, look over your specific insurance policy before you buy and don’t be afraid to look into any fine print if something seems off to you.

Final Thoughts

While no travel insurance is perfect, Heymondo has proven to be user-friendly for us, with a nice selection of plans from basic travel medical to annual multi-trip. The coverage is solid, the app is a great convenience, and the peace of mind that comes with knowing we’re protected is priceless. If you’re planning a trip, whether it’s a short getaway or a longer adventure, we’d recommend giving Heymondo a look. It might just make your travels a little less stressful and a lot more enjoyable.